An HSA is your health savings powerhouse

Smart and easy. That’s the power of an HSA. It lets you set aside pretax dollars to pay for qualified expenses, saving you up to 30% on eligible items and services.* Benefits include:

- You’re in control, starting with deciding when and how much to contribute.

- You can manage your HSA 24/7 online or by using our mobile app.**

- The funds in your HSA are always yours, even when you retire.

A wide range of eligible expenses, a smart way to pay

There are all kinds of qualified expenses you can pay for using your HSA, from medical visits, braces and contacts to prescriptions, sunscreen and more. Your payment card makes paying fast and easy, whether it’s in-store, online, at your doctor’s office or after you receive a bill.

If you're curious to know what else you can buy with your health savings account payment card, visit our eligible expenses page.

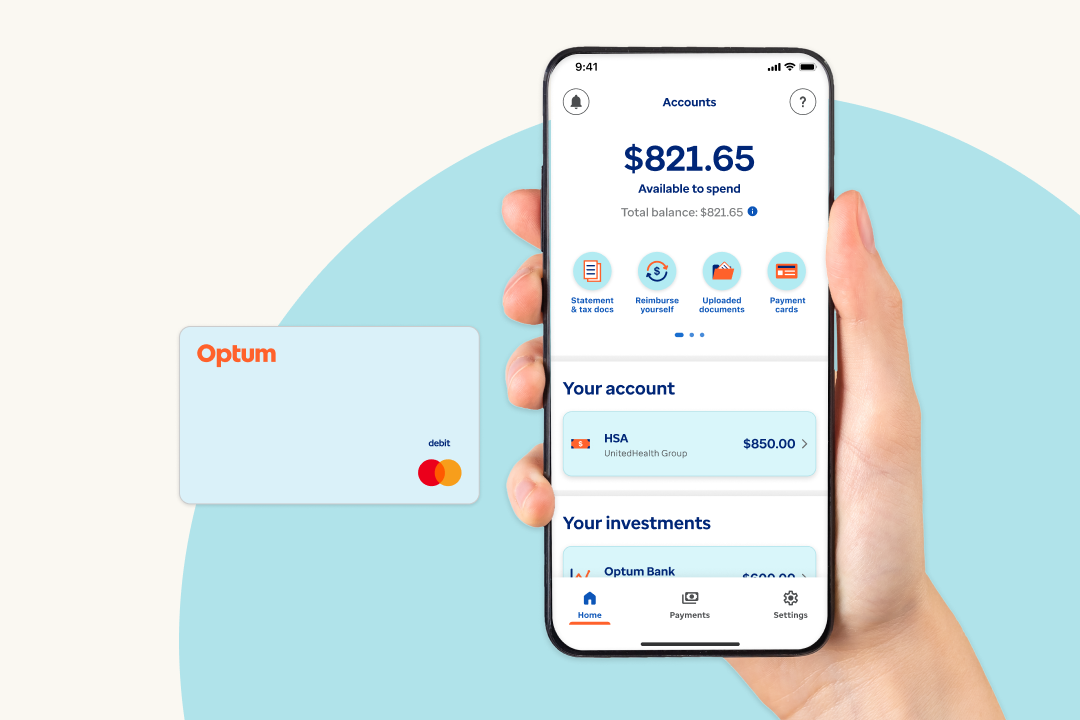

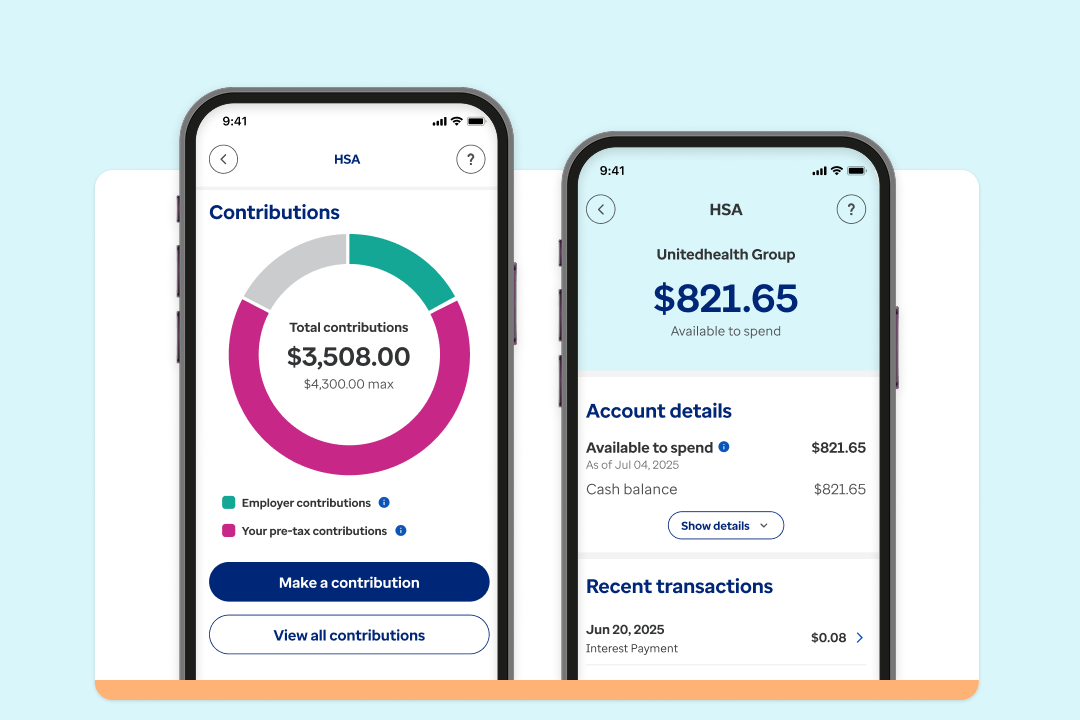

Manage your HSA easily with the Optum Bank app

From innovative financial solutions to personalized support and guidance, our app helps you make the most of your account benefits anytime, anywhere:**

- Check your balance.

- Pay a bill or submit a claim.

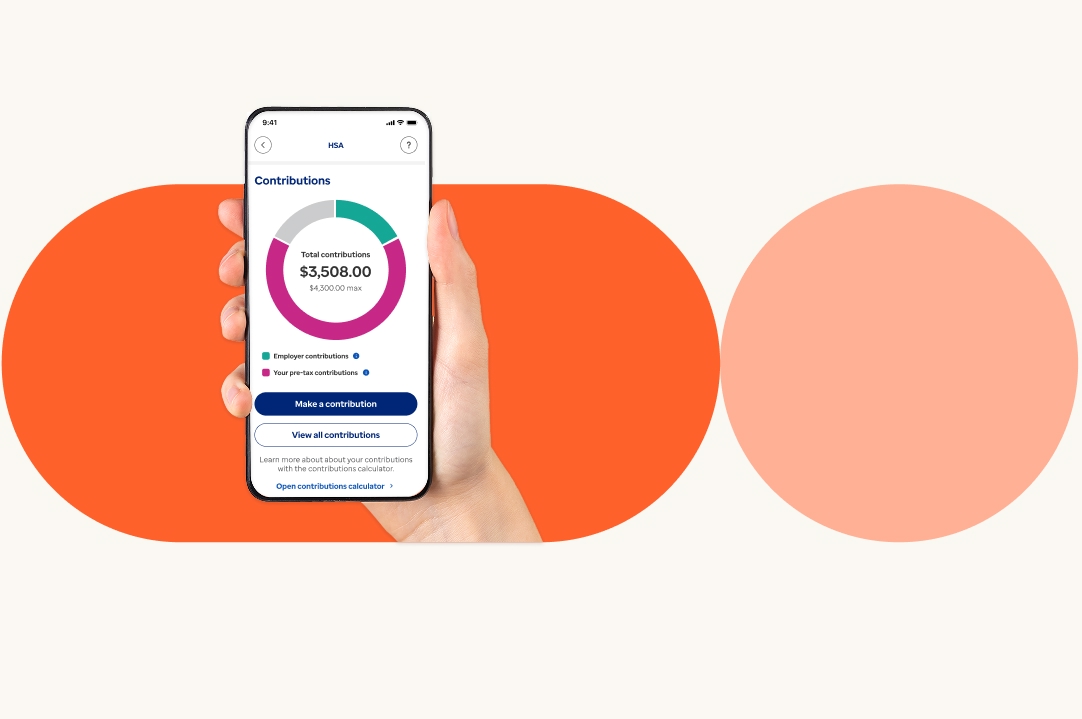

- Manage your contributions.

- Invest your HSA funds.

- Get account support.

| Scan this QR code to download the mobile app |

Optum Bank HSA FAQ

A health savings account is a tax-advantaged account that helps you pay for qualified medical expenses. You can contribute pretax dollars, grow your savings tax-free and withdraw funds tax-free for eligible health costs. It’s a smart way to manage current expenses and save for future health care needs.

The main requirement for opening an HSA is having a qualifying high-deductible health plan (HDHP) that meets IRS guidelines.

There are several ways to contribute to your HSA:

- Sign in to your account to set up one-time or recurring deposits.

- Mail in a check.

- Set up payroll deductions from every check if your employer offers it.

- Contribute using the Optum Bank mobile app.

The IRS sets guidelines for how much you can contribute to an HSA each year. To learn more, visit our HSA contribution limits page.

Sign in to your account today and check your contribution limit.

Your HSA makes paying for qualified expenses fast and easy. You can:

- Use your Optum Bank debit Mastercard® at the time of purchase or after you receive a bill.

- Pay bills online or use the Optum Bank mobile app.

- Reimburse yourself for a payment you’ve made.

You can use your HSA to pay for the qualified medical expenses of anyone you claim on your taxes, even if you're only enrolled with single coverage. It’s a great way to plan for unexpected medical expenses — from deductibles to ER visits — for the whole family.

An HSA can help you prepare for future health care costs and retirement by enabling you to save money income tax-free. After you reach age 65, you can use your HSA funds for non-qualified expenses, from home repairs to vacations. You’ll pay regular income tax on those funds, but the 20% tax penalty no longer applies.

It’s important to ensure that your HSA information is current and that you’ve selected a beneficiary. A beneficiary can be one or more individuals — for example, a spouse, children, relatives and/or friends.

If you don’t assign a beneficiary, your HSA funds will default to your legal surviving spouse, if you have one, or to your estate. If your funds are left to your estate, it may face heavier taxation. For these reasons, it’s important to keep your beneficiary information up to date.

You can do this in 3 easy steps:

- Sign in to your account by visiting optumbank.com. Select Settings from the black drop-down menu, then choose Beneficiaries.

- Select + Add a New Beneficiary. You’ll need the date of birth and Social Security number for the individual(s) you’re adding.

- Complete the online form, then select Submit.

If you have multiple HSAs with different providers, you can transfer them into a single account with Optum Bank for convenience. This is also called an HSA rollover. The process is straightforward and can help you manage your HSA funds more efficiently. Combining your HSAs is easy to do. Learn about HSA transfers.

If you change jobs, you can keep your account and the money in it remains yours. If your new employer offers an HSA, you can continue contributing to your Optum Bank® account instead of opening a new one.

You can keep and use the money in your HSA even if you no longer have a qualifying HDHP or if you’re enrolled in Medicare. You do not have to close your account. However, you can no longer contribute to your HSA once you’re enrolled in Medicare.

Learn more about HSAs and Medicare

Learn about Medicare Advantage medical savings accounts (MSAs)

Yes, you can close your health savings account. Reasons for doing this may include consolidating various HSA accounts. But before you close your account, consider the following:

- Taxes and penalties: If you withdraw funds for non-medical reasons before you’re 65, you may need to pay taxes and penalties. After age 65, you can withdraw funds for any reason without penalty, but you’ll still owe income tax.

- 60-day rule: If you receive a distribution of your HSA funds by check or direct deposit, you have 60 days to contribute those funds to another HSA or use them for qualified expenses to avoid taxes and penalties.

- Liquidate investments: If you have invested a portion of your HSA, you need to sell those investments before the account can be closed.

- Stop employer contributions: If your employer contributes to your HSA, be sure to stop those contributions before closing.

To close your HSA:

- Contact your HSA provider for information about the process.

- Fill out any required forms.

- Pay any closure fees.

- Make sure your HSA provider has updated contact information for you in case there are any questions.

Featured resources

Article

Learn how to manage your HSA so you can save on taxes and pay for qualified medical expenses.

Article

Do you have a health savings account (HSA) with another provider? Save time by combining your HSAs into one account with Optum Bank.

Article

Are you taking full advantage of all your HSA's tax benefits by contributing the maximum each year?

*Savings compares using pretax income in your HSA to using after-tax income for purchases and assumes a 30% combined tax rate from all applicable federal, state and FICA taxes. Results and amount will vary depending on your circumstances.

**Data rates may apply.