Learn how our health benefit accounts can benefit you

Manage your health dollars with the Optum Bank app

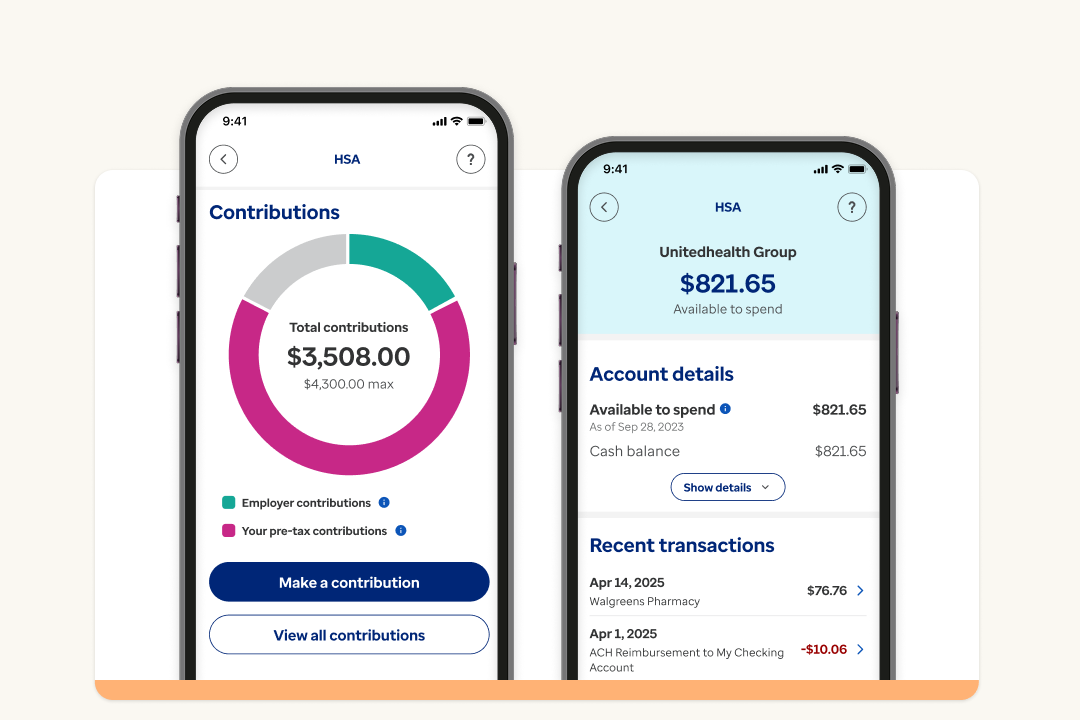

Our app provides personalized support and guidance to help you make the most of your account benefits anytime, anywhere.* You can:

- Track account balances with ease.

- Maximize tax savings by contributing the max each year.

- Cancel your payment card if it’s lost or stolen.

- Reimburse yourself or pay bills.

| Scan this QR code to download the mobile app |

Save in-store and online with your payment card

The Optum payment card makes it easy to use your health benefits when and where you need them. Whether you're picking up a prescription, shopping online or paying a provider, it offers quick access to your funds so you can take care of your health without the hassle.

Featured resources

Article

Take advantage of all of your HSA's tax benefits by contributing the maximum each year.

Video

Watch this video to discover how the investing features work for a health savings account (HSA).

Article

Learn how to manage your HSA so you can save on taxes and pay for qualified medical expenses.

*Data rates may apply.