*HSA funds used for non-qualified medical expenses are taxed and subject to a 20% penalty if the HSA holder is less than 65 years of age. After age 65, HSA funds for non-qualified medical expenses are taxed (but not penalized).

Featured resources

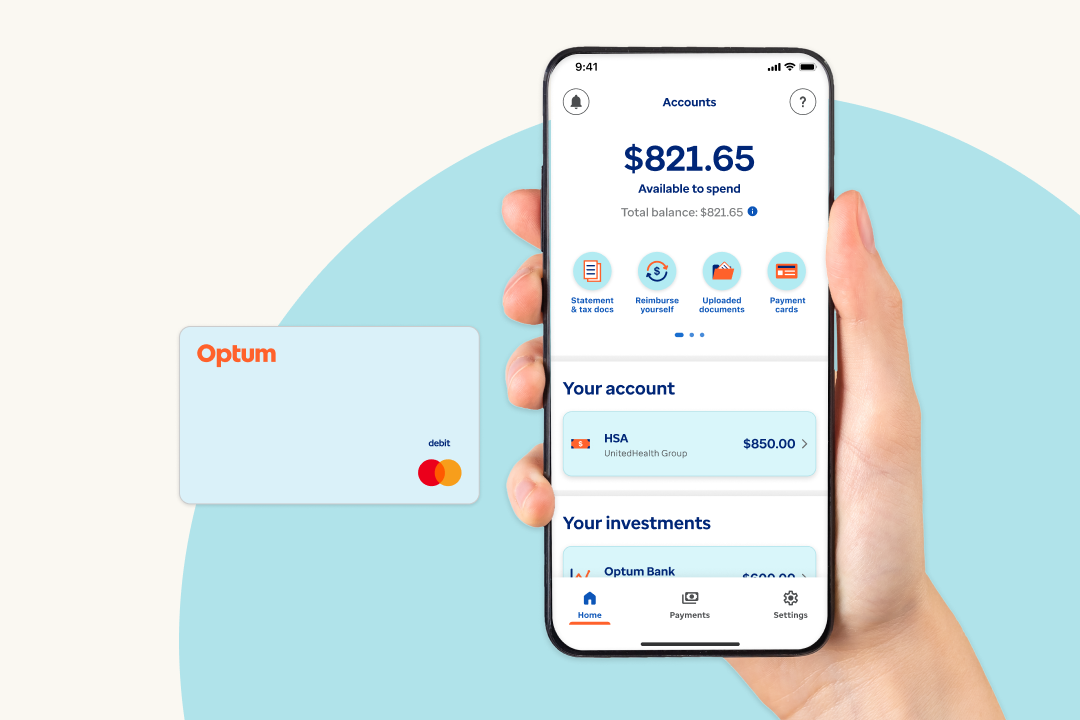

Health benefit account

Discover how an Optum Bank HSA can help you save on taxes and pay for qualified medical expenses. Learn about benefits, eligibility and how to get started.

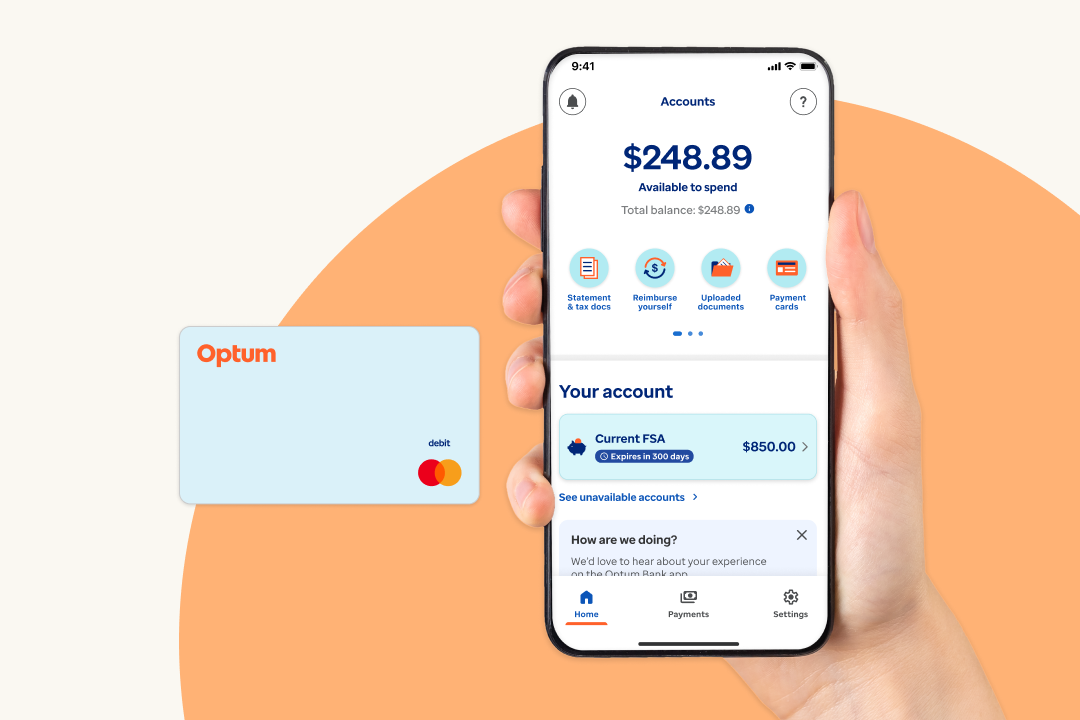

Health benefit account

Maximize your health care savings with an Optum Bank FSA. Use pretax dollars for everyday medical expenses and save up to 30% on eligible purchases.*

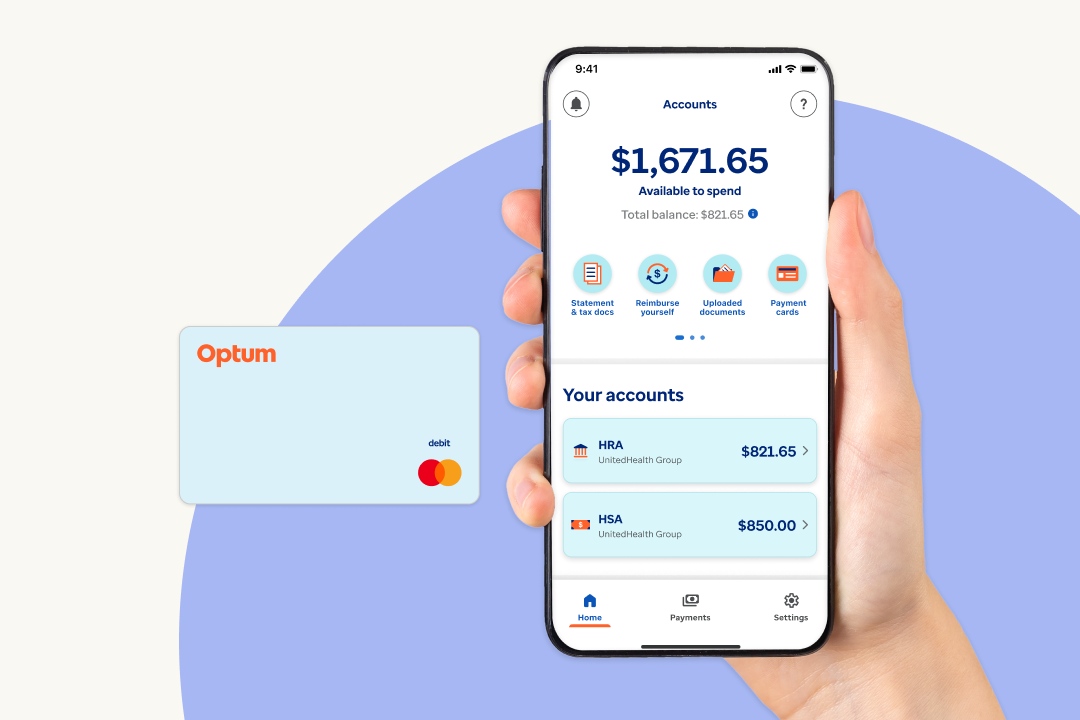

Health benefit account

Optum Bank HRAs are a way for employers to help offset employees’ health care costs for eligible expenses and gain tax advantages.