An MSA can help you manage health care costs

An MSA is a type of Medicare Advantage Plan (Part C). It combines a high-deductible health plan with a medical savings account. Your MSA is funded yearly with money from Medicare, which you can use to pay for Medicare-covered costs until you reach your plan’s deductible.

In general, Medicare MSA plans:

- Let you get care from any Medicare-approved doctor, health care provider or hospital

- Cover all services that Original Medicare covers (Part A and Part B)

- Don’t include prescription drug coverage; you need a separate Medicare drug plan for that (Part D)

- Pay 100% of costs for covered services once you meet your deductible

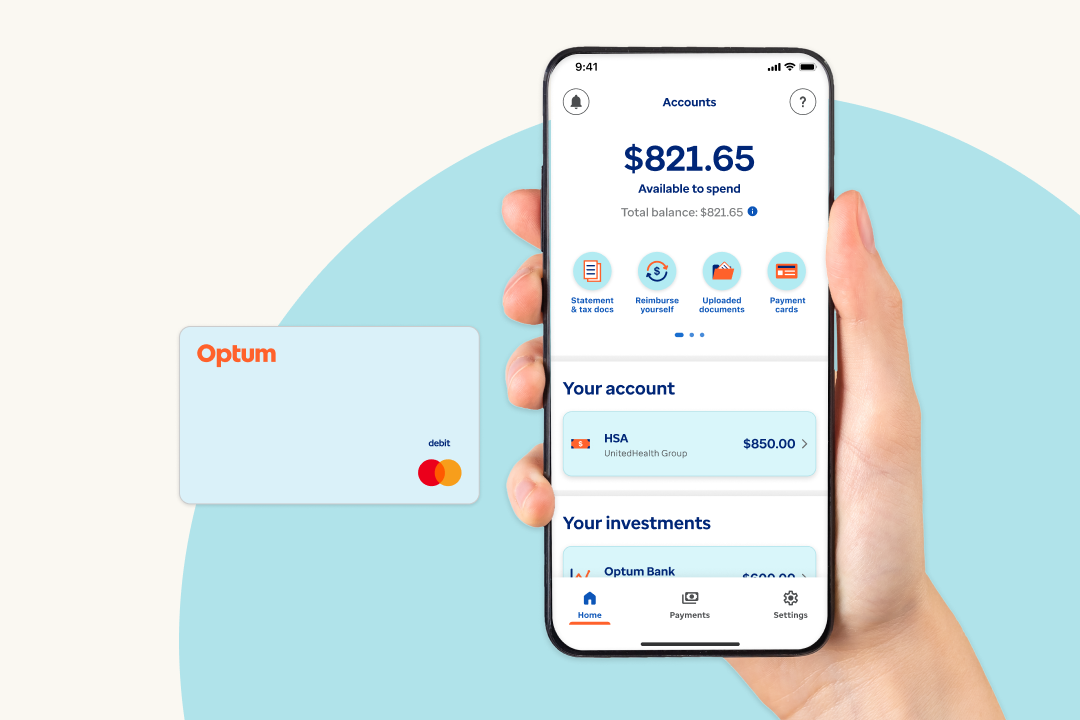

Take charge of your MSA with the Optum Bank app

The Optum Bank app gives you maximum control over your account.* Use it to quickly access your MSA when and where it’s convenient for you. Once you sign in, you can:

- Check your balance.

- Get education and access to tools.

- Manage and view payment card.

- Manage your account.

- Search qualified expenses.

- Submit receipts.

- Pay a bill.

| Scan this QR code to download the mobile app |

Optum Bank medical savings account FAQ

A Medicare Advantage MSA plan is a special type of Medicare Advantage plan (Part C). It offers freedom of choice if you want greater control over your health care dollars and decisions.

A Medicare Advantage MSA plan has 2 parts. To be eligible:

- First, enroll in a qualifying high-deductible Medicare plan.

- Next, open an MSA through your health plan provider. Your provider will open your account with Optum Bank, Member FDIC.

Once your account is set up:

- Medicare will deposit an amount of money into your MSA every year through your plan provider.

- You can use that money to pay for qualified medical expenses, including costs not covered by Medicare. Funds cannot be used for the qualified medical expenses of any other person, including a spouse.

- If you use all of your MSA funds, you’ll pay out-of-pocket until you reach your deductible. When that happens, your plan will pay for Medicare-covered services.

Most people with Medicare Part A and Part B can join a Medicare Advantage MSA plan. You cannot join if you:

- Are eligible for Medicaid

- Currently receive hospice care

- Live outside of the U.S. more than 183 days a year

- Have TRICARE or Department of Veterans Affairs benefits

- Have health coverage that would cover the Medicare Advantage MSA plan deductible, including benefits from an employer or union retiree plan

- Are a retired employee of the federal government and are in the federal employee health benefits program (FEHBP)

Whether you already have an MSA or plan to open one, naming a beneficiary is important. Here’s why:

- If you don’t assign a beneficiary, your MSA funds will default to your legal surviving spouse, if you have one, or to your estate.

- Funds left to your estate may face heavier taxation.

Given this, it’s important to assign a beneficiary and keep beneficiary information up to date. Beneficiaries can be one or more individuals, for example, a spouse, children, relatives and friends.

To add a beneficiary:

- Sign in to your account at optumbank.com. Select Settings from the drop-down menu, then click Beneficiaries.

- Select + Add a New Beneficiary. You’ll need the date of birth and Social Security number for the individual(s) you’re adding.

- Complete the online form, then select Submit.

You may withdraw money from your MSA tax-free and use it to pay for qualified medical expenses. These include costs for services covered by Medicare Part A and Part B and other expenses. Qualified expenses are defined by the Internal Revenue Service (IRS).

Funds withdrawn and used to pay for non-qualified expenses will be taxed. A penalty also applies.

Featured resources

Health benefit account

Discover how an Optum Bank HSA can help you save on taxes and pay for qualified medical expenses. Learn about benefits, eligibility and how to get started.

Article

A health savings account (HSA) can be a powerful tool for retirement planning. Learn to grow your savings and prepare for future health care costs.

*Data rates may apply.