Annual contribution limits

Each year, the Internal Revenue Service (IRS) sets contribution limits for health savings accounts (HSAs).

Contributing the maximum to your HSA each year could help you build up your nest egg so you're prepared for expected, and unexpected, health care costs.

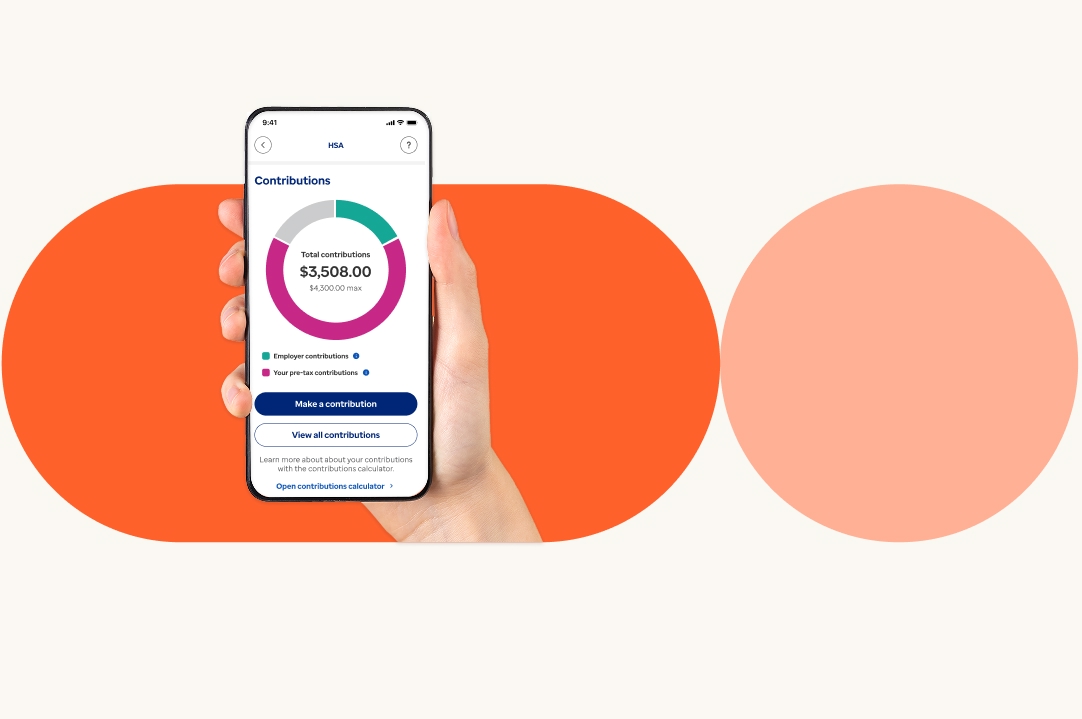

You are responsible for monitoring the amount deposited into your HSA each calendar year. Keep in mind that if your employer contributes funds, those also count toward the maximum. If you exceed the maximum contribution limit, there is a penalty imposed by the IRS. Sign in to your account online to download the Excess Contribution and Deposit Correction Request Form to request an excess contribution refund or a correction to a contribution.