Our health care FSA can make your money work harder

Health care flexible spending accounts are offered through your employer. They allow you to set aside pretax funds from every paycheck, helping you save up to 30% on qualifying health and care costs for you and your eligible dependents.*

Access FSA funds instantly and adjust contributions if needed

When you enroll in an FSA plan:

- You decide how much to set aside every pay period for the entire plan year.

- All of that money is put into your account at the start of the plan year, helping you cover expenses right away.

- If you need to adjust your contributions due to qualifying life events, you can.

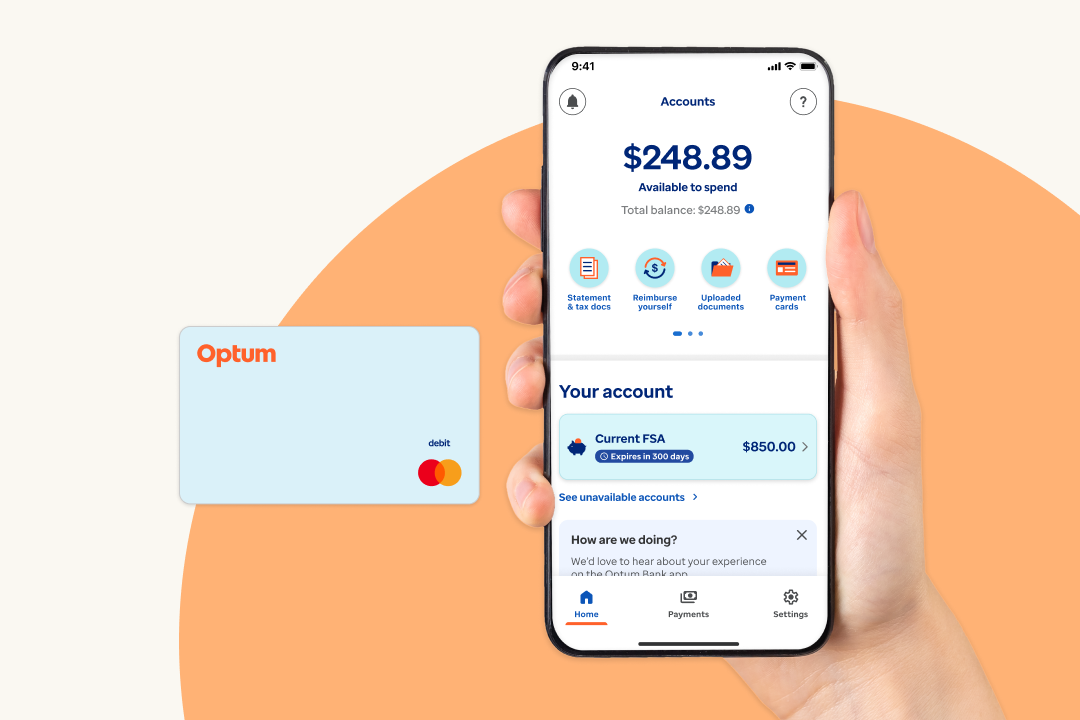

Save up to 30% with your Optum payment card

Your payment card is the fastest, easiest way to pay for qualified expenses like bandages, braces, chiropractors and more. You’ll save up to 30% since you’re using pretax dollars.* Using your card also lowers the need for documentation and makes managing expenses easier.

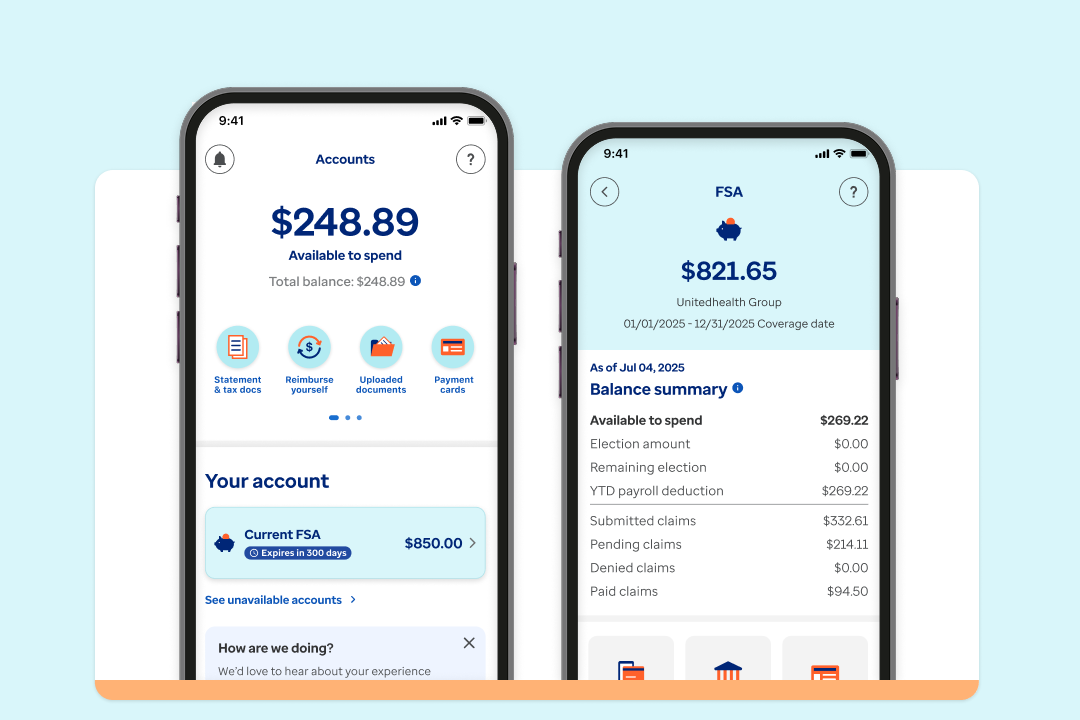

You’re in control with the Optum Bank mobile app

Fast, easy access to your FSA account anytime, anywhere. That’s the power of our mobile app.** Simply sign in to:

- Check your balance.

- Upload receipts.

- Access tools and helpful resources.

- Manage and view your card.

| Scan this QR code to download the mobile app |

Optum Bank FSA FAQ

Eligible expenses include medical, dental, vision, hearing and prescription drug costs. You can also use FSA funds to pay for copays, coinsurance and certain over-the-counter (OTC) items.

Qualified medical expenses can be found in IRS Publication 502.

Due to frequent updates to the regulations governing FSAs and HSAs, this list is to be used as a guide for the submission of claims. It does not guarantee reimbursement.

You can use your FSA to pay for eligible expenses incurred by any of the following individuals:

- Yourself

- Spouse

- Qualifying child

- Qualifying relative

New rules allow a dependent to be eligible for the plan, even when that dependent does not qualify to be claimed as your tax dependent on your tax return. Optum recommends that you check with your tax advisor before you make your election for the plan year.

Beginning January 1, 2026, health care FSA (HCFSA) contributions are limited by the IRS to $3,400 each year (this is a $100 increase from the 2025 limit of $3,300). The limit is per person — each spouse in the household may contribute up to the limit.

Your employer may elect a lower contribution limit. Please see your plan documents or check with your Human Resources office for the specifics of your FSA Health Care Plan. The limit may be adjusted annually to account for inflation increases.

The health care FSA carryover is effective for the amount carrying over from a plan year beginning in 2025 to the following plan year. So, a plan ending December 31, 2025 would allow for $680 to be carried over to the 2026 plan year. Any amount that rolls over into the 2026 plan year does not affect the maximum limit that employees can contribute.

The dependent care FSA limit for 2026 is $7,500 per year, if married and filing a joint return or a single parent, or $3,750 per year per parent if married and filing separately.

Tax savings are the biggest advantage to enrolling in an FSA. Every dollar you set aside in your account reduces how much you pay in income taxes. Plus, you can be reimbursed for qualified expenses that you are already paying for.

Your contributions to your FSA are pretax or tax-deductible.* Tax-free withdrawals are made to pay your out-of-pocket expenses related to health care and dependent care.

Because of these tax advantages, the more you use your FSA, the more money you could save. The amount of savings will depend on your personal tax rate.

*Contributions are tax-deductible on your federal tax return. Some states do not recognize FSA contributions as a deduction. Consult a qualified tax advisor for advice.

Your taxable income is reduced by the amounts you deposit into your FSA accounts, up to IRS limits.

Here’s an overview of how an FSA works:

- Funding: You will contribute a pre-determined amount to your account. In some cases, your employer may also contribute to employee FSAs. Your funds will be available for use on the first day of your plan year.

- Accessing funds: When you have eligible health care expenses, pay for them with your payment card, or pay out of pocket and request reimbursement online. Remember to always keep your receipts.

- Requesting reimbursement/substantiating purchases: It’s quick and easy to request reimbursement for eligible expenses paid using personal funds, or to submit documentation for card purchases. Our documentation upload features online and on the mobile app will save you time and make your life easier. (Please remember that credit card receipts, non-itemized cash register receipts and cancelled checks are not acceptable forms of documentation. Always request an itemized receipt or explanation of benefits (EOB) from your health care provider or merchant.)

- Claims processing: We will promptly process your request and reimburse you either by check or direct deposit if you sign up for that feature.

- Account management: Log in to your online account or the mobile app to check your account balance, set up your family profile, add a bank account to enable faster reimbursements or request a debit card in a dependent’s name.

Generally, money remaining in your FSA at the end of the plan year will be forfeited. This is commonly known as the “use-it-or-lose-it” rule. However, some plans may allow you to continue submitting claims beyond the end of the plan period for eligible expenses incurred before the deadline.

Also, some plans may allow you to continue spending your FSA dollars through a defined grace period or to carry over a portion of your remaining balance. So be sure to check the specific plan rules in your summary plan description (SPD). To do this, contact your HR department or ask for additional details from Optum Consumer Services.

If you don’t use your Optum payment card, you may file claims for reimbursement in 2 ways:

- File an online claim, starting by logging in to your account online or on the Optum Bank mobile app. Then click on the file claim link on your home page and walk through the steps to enter the claim details. Once you’ve filed your claim, you must agree to the terms and conditions and click the submit button. To complete the reimbursement process, send your confirmation page along with your supporting documentation to us.

- File your claim using the FSA reimbursement request form (see Forms on our website). To do this, follow the instructions that will be provided. Claims and copies of your supporting documentation can be submitted via email, fax or mail.

Certain qualifying events allow employees to increase/decrease their election or begin/end participation in a plan. Common qualifying events can be found on the FSA status change form and include marriage, divorce, birth, death or a change in the cost of dependent care.

Please refer to your employer’s plan document for further guidance on qualifying status change events applicable to your plan.

Participation in the FSA ends if you terminate employment. This means only expenses incurred prior to the date your participation in the plan ends are eligible for reimbursement. Claims for expenses incurred prior to the plan termination date must be submitted within the “run-out” period.

The “run-out” is a specified period of time after the end of the plan year, or following your termination in the plan, in which you may continue to submit claims incurred during your period of coverage.

This is not a period when you are able to continue to incur new expenses. Rather, it allows you time to gather and submit expenses before forfeitures are applied. For example, if your plan has a 90-day run-out period, you have 90 days from your date of termination to submit expenses incurred prior to the termination date.

Featured resources

Article

Understand how to submit claims and get reimbursed for eligible expenses through your Flexible Spending Account (FSA).

Article

Have you used all your FSA funds yet? Learn more about what you can spend remaining funds on.

Video

Watch this video to learn more about why pairing a limited purpose FSA with an HSA might be a smart choice.

*Savings compares using pretax income in your FSA to using after-tax income for purchases and assumes a 30% combined tax rate from all applicable federal, state and FICA taxes. Results and amount will vary depending on your circumstances.

**Data rates may apply.