Stretch the value of your health care dollars

A health reimbursement arrangement (HRA) is a great way to make the most of your health care dollars. Your employer will contribute a fixed amount to your account every year, which you can use to pay for eligible expenses. Account features:

- Employer contributions are not considered income and are not subject to taxes.

- Your employer chooses which health care expenses are eligible.

- HRAs are funded solely by employers. Individuals cannot contribute to an HRA.

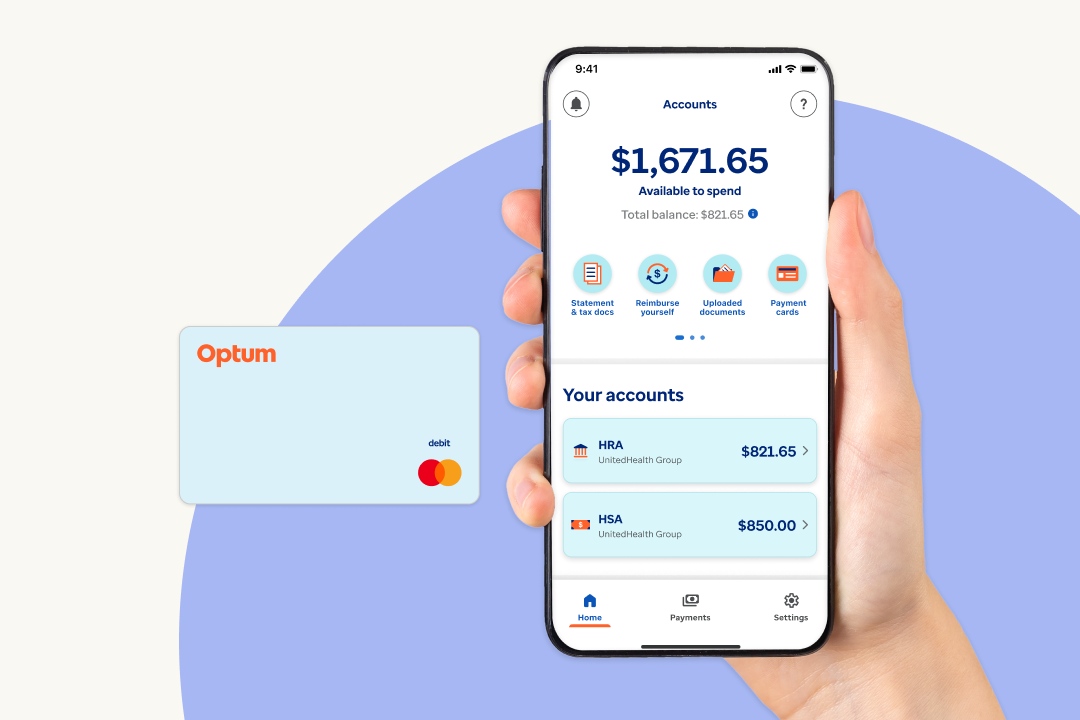

Manage your HRA using the Optum Bank mobile app

Stay on top of your HRA anytime, anywhere. That’s the power of our mobile app.** Use it to save time and take control, from searching for qualified expenses to fast-tracking payments. Simply sign in to:

- Check your balance.

- Manage claims.

- Submit documentation.

- Pay a bill.

| Scan this QR code to download the mobile app |

Optum Bank HRA FAQ

With an HRA, employers contribute money for each employee to pay for eligible out-of-pocket medical costs. Employers can choose to allow funds to be used for all qualified medical expenses approved by the IRS or a subset of eligible qualified expenses.

When employees incur eligible qualified medical expenses, they can submit claims to be reimbursed from the HRA.

You can pay for eligible health care expenses, then submit a claim online or by email, mail or fax. Be sure to include a receipt that shows:

- The name of the doctor or other service provider, pharmacy or store

- The date of service or purchase

- A description of the service(s) or item(s) purchased

- The amount charged, or what you are responsible for paying

Your Optum Bank HRA includes an Optum Bank payment card. It’s a fast, easy way to pay for eligible medical expenses without submitting paper claim forms.

Use it at the pharmacy, pay at the doctor’s office or write your payment card number on your provider bill. Just remember to keep your receipt, because transactions may have to be validated or substantiated per IRS guidelines.

Featured resources

Article

Learn how to file Health Reimbursement Arrangement (HRA) claims and get reimbursed with Optum Bank. Simple steps and support resources.

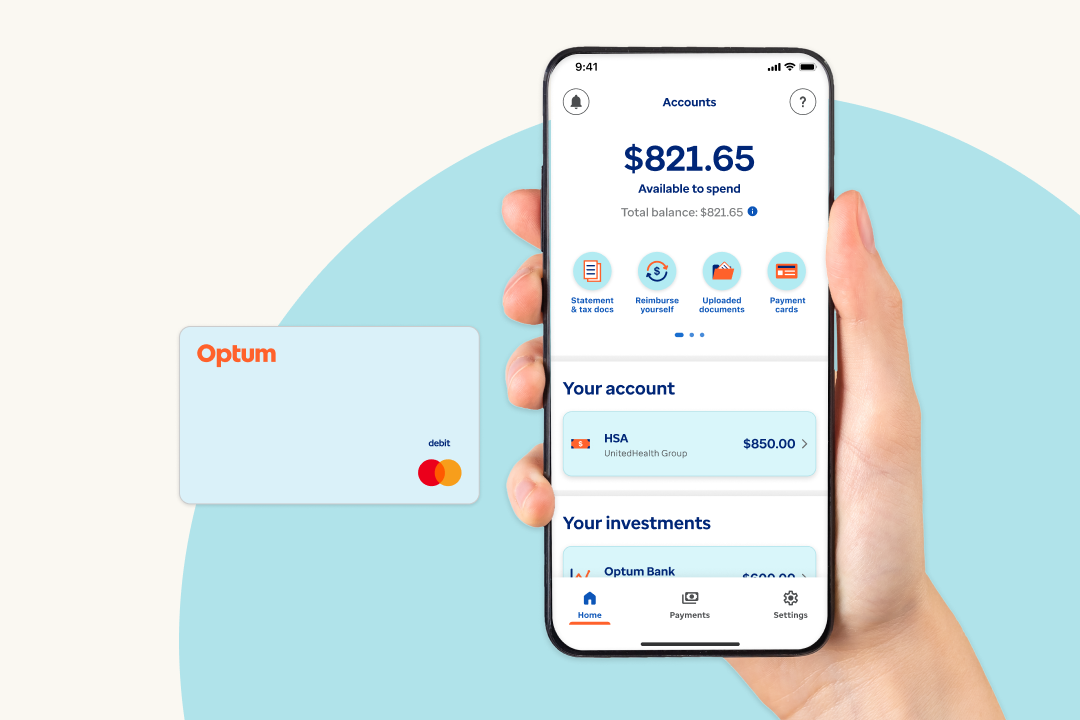

Health benefit account

Discover how an Optum Bank HSA can help you save on taxes and pay for qualified medical expenses. Learn about benefits, eligibility and how to get started.

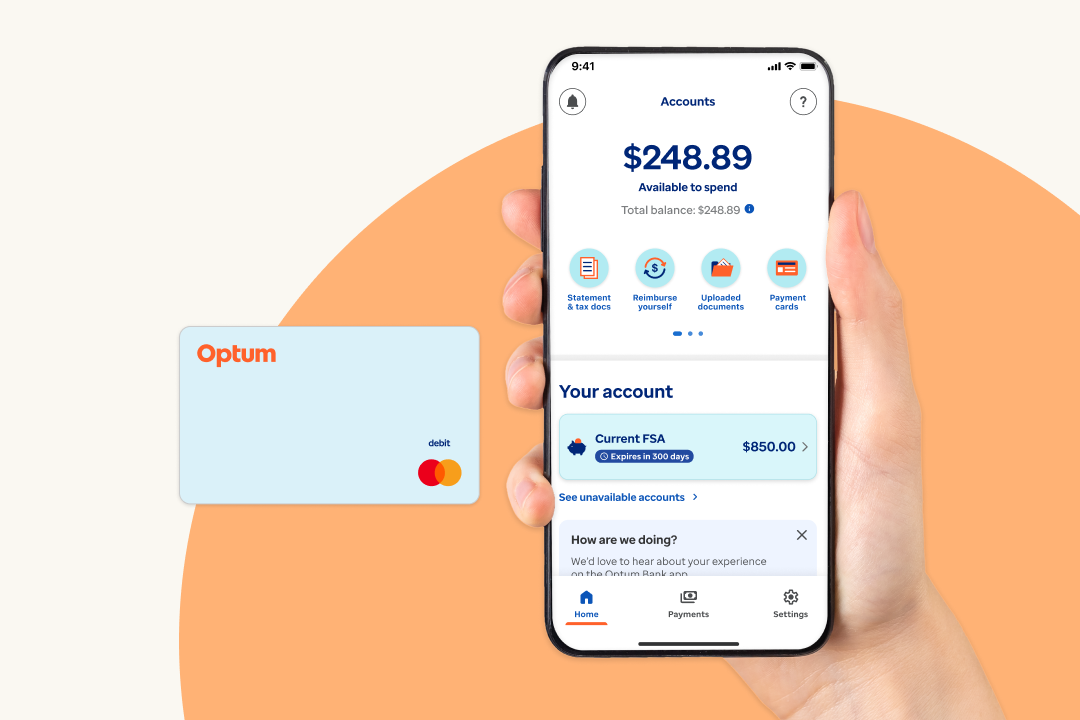

Health benefit account

Maximize your health care savings with an Optum Bank FSA. Use pretax dollars for everyday medical expenses and save up to 30% on eligible purchases.*

*Assuming a 30% combined tax rate from all applicable federal, state and FICA taxes. Results and amount will vary depending on your circumstances.

**Data rates may apply.