Health benefit accounts resources

Learn how to make the most of your health benefit account.

Explore by:

HSA | FSA | HRA | DCFSA | Calculators and tools | Mobile app | Payment card | Optum Bank Academy

HSA resources

Article

Learn how to manage your HSA so you can save on taxes and pay for qualified medical expenses.

Article

Do you have a health savings account (HSA) with another provider? Save time by combining your HSAs into one account with Optum Bank.

Article

Are you taking full advantage of all your HSA's tax benefits by contributing the maximum each year?

FSA resources

Video

Watch this video on what health care flexible spending accounts (FSAs) are and how they work.

Article

Have you used all your FSA funds yet? Learn more about what you can spend remaining funds on.

Video

Watch this video to learn more about why pairing a limited purpose FSA with an HSA might be a smart choice.

HRA resources

Article

Learn how to file Health Reimbursement Arrangement (HRA) claims and get reimbursed with Optum Bank. Simple steps and support resources.

DCFSA resources

Article

Learn how to file claims and receive reimbursements for eligible dependent care FSA expenses thru Optum Bank. Simple steps and helpful resources included.

Video

Watch this video to learn how you can use tax-free money to pay for dependent care.

Calculators and tools

Tools

Use our qualified medical expense tool to filter by account type and expense type to see if it qualifies.

Calculator

Use this calculator to estimate your contributions, forecast your tax savings and explore how your HSA can grow over time.

Tools

The Optum Bank Health Savings Checkup tool gives you a personalized estimate of health care costs in retirement so you can be prepared.

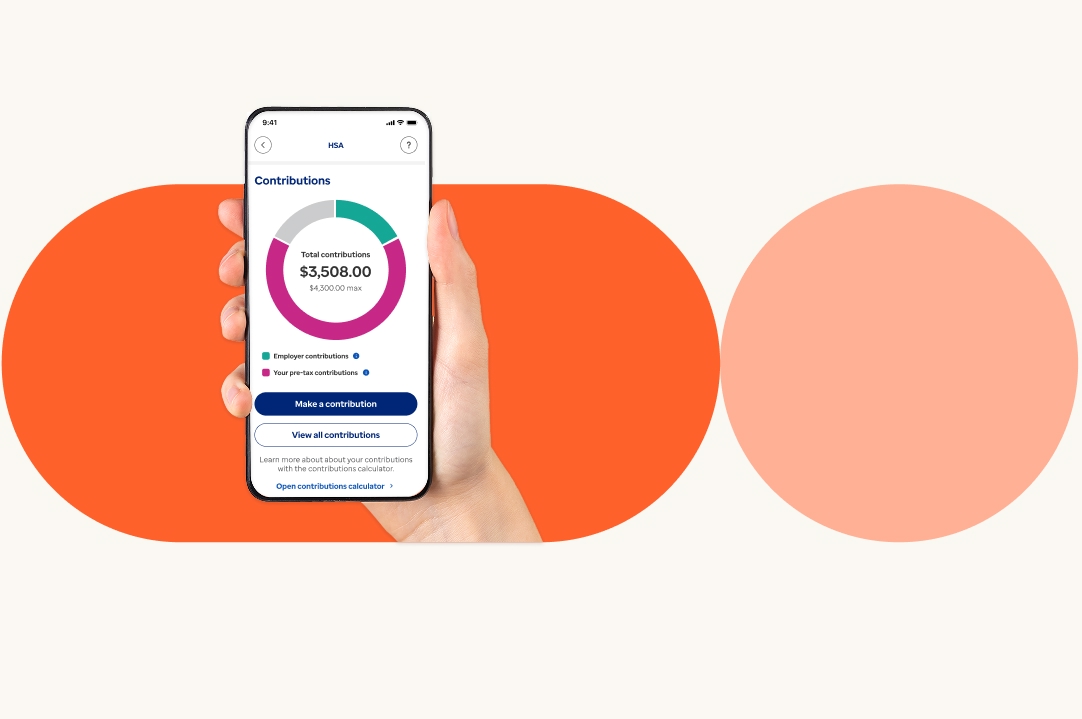

Mobile app resources

Article

With an app, artificial intelligence and Apple Pay, Optum Bank has made it even easier to save and pay for qualified medical expenses.

Payment card resources

Video

Your card is the most convenient way to pay for all qualified expenses. Plus, you save up to 30% since you’re using pretax dollars. Learn how here.*

Article

Learn how to use your HSA–FSA card online and in store to pay for and save on medical expenses like doctor visits, medicine and more.

Video

Add your HSA card to your phone or watch and always have access to your account funds.

Optum Bank Academy

On Demand Learning

Enhance your understanding of health benefits accounts with Optum Bank Academy. Access educational courses, webinars and more.

*Assuming a 30% combined tax rate from all applicable federal, state and FICA taxes. Results and amount will vary depending on your circumstances.