Scan to download the Optum Bank app

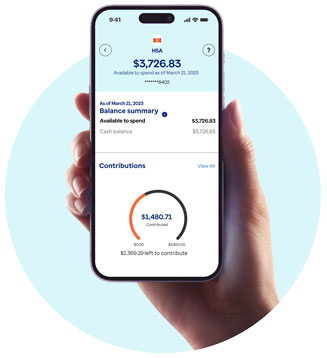

Unlock your health dollars

We help make your health dollars go further, so you have more to spend on the things you love.

Manage your health accounts

Check health accounts, track receipts, pay bills, add money and more 24/7.

Boost your balance

Get a tax break with every HSA contribution while saving for future health needs.

Top