Important things to know

Making the most of your HSA starts with knowing what it offers:

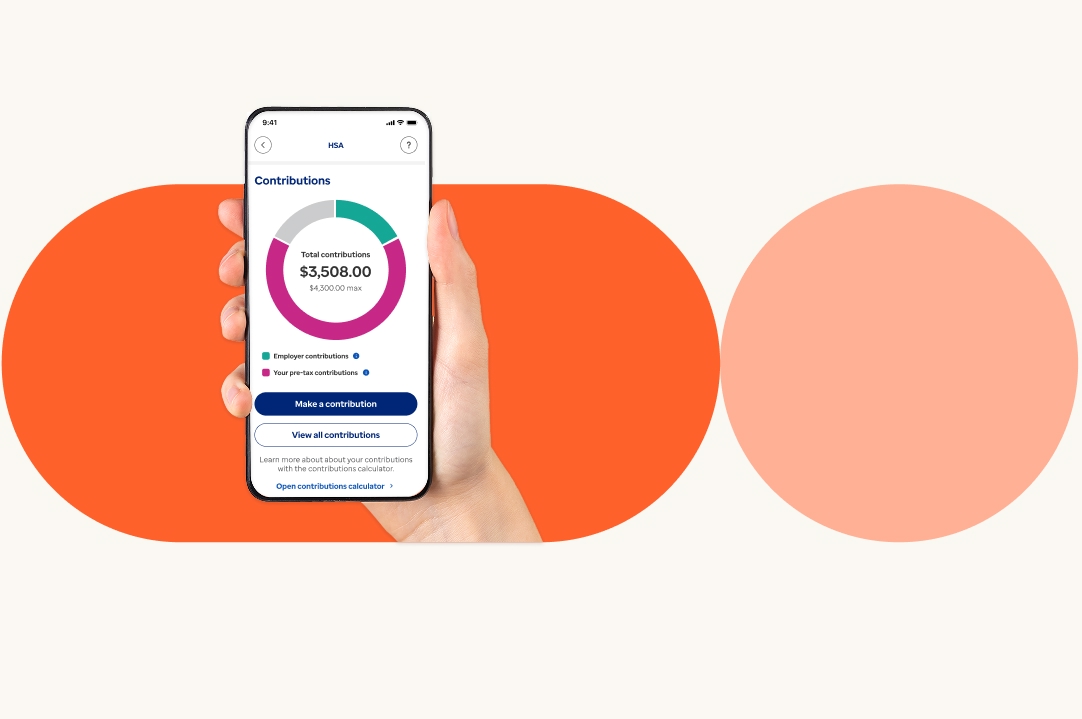

- Contributions, growth through interest and withdrawals for qualified expenses are not taxed. Learn how to save on taxes with your HSA.

- Your HSA is yours — ALWAYS — even if you change jobs or retire. Learn how to maximize your HSA savings.

- After you reach $1,000, you can choose to invest. Learn how to invest your HSA dollars.