Contributions are made with pretax dollars, saving you money

A dependent care flexible spending account (DCFSA) helps you put aside money for the care of children under 13 or dependent adults who can’t care for themselves. Your account is funded by payroll deductions before taxes. Features include:

- Easy enrollment through your employer's benefit options

- For 2026 contribute up to $7,500 per household per year or $3,750 if you’re married and file separately

- Contributions are deducted from your paycheck before taxes, saving you money

- Access to funds as soon as they’re added to your account

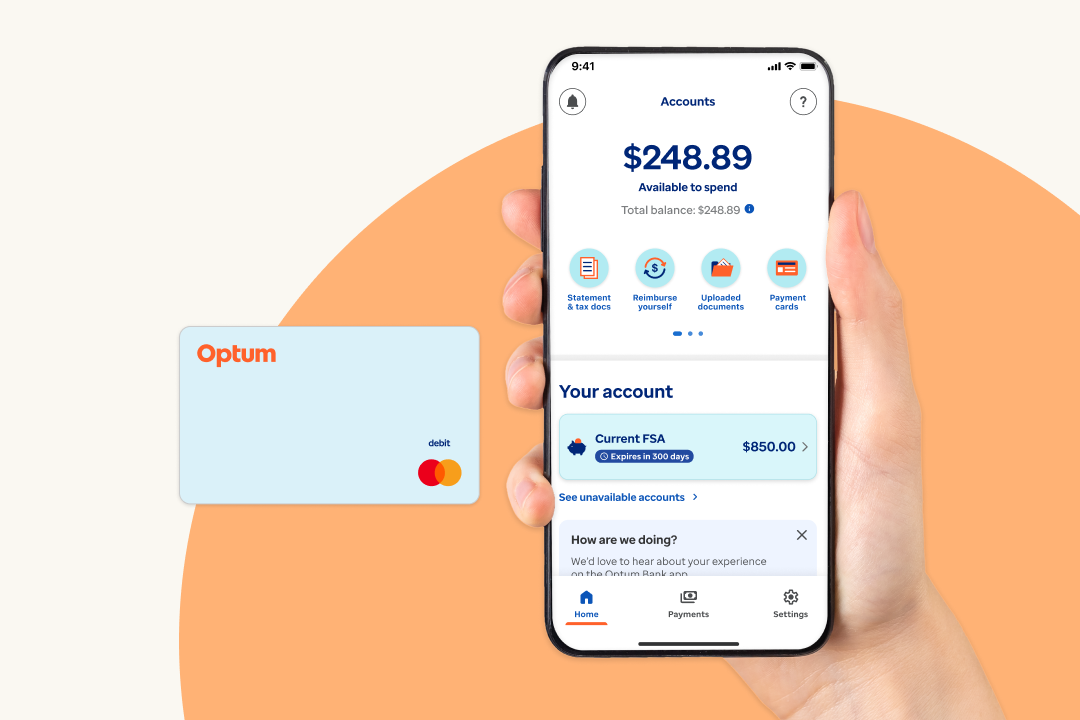

Manage your DCFSA easily online or with the Optum Bank app

Stay on top of your DCFSA at optumbank.com or by using our mobile app.** Both offer a quick view of your account and let you manage it when and where it’s best for you. Once you sign in, you can:

- Check your balance

- Get information and access to tools

- File a claim

- Upload a receipt

- And much more

| Scan this QR code to download the mobile app |

DCFSA basics FAQ

You’re eligible to enroll in a dependent care FSA if you have a dependent (whose expenses are eligible) who requires care to enable you to work. In addition, you must meet one of the following eligibility criteria:

- You are unmarried.

- Your spouse works, is a full-time student, is actively seeking work or is disabled (incapable of self-care).

- You are divorced or legally separated and have custody of your child even though your former spouse may claim the child for income tax purposes. Your dependent care FSA can be used to pay for childcare services provided the period the child resides with you.

Eligible dependents include:

- Children under age 13 who are claimed as a dependent for tax purposes

- Care of a disabled spouse or disabled dependent of any age

Once you enroll, you choose how much to contribute every paycheck. For 2026, you can contribute:

- Up to $7,500 per household per year if you’re married and file a joint return

- Up to $3,750 for the year if you’re single or married and file separate returns

Your employer then deducts that amount every pay period, before taxes. You typically don’t have to pay federal, state or payroll taxes on the money credited to your account.*** In other words, you save money as you lower your income taxes.

There are several types of flexible spending accounts — a health care FSA, a limited-purpose FSA and a dependent care FSA. All help you pay for various types of out-of-pocket expenses every year. Here’s how they work.

Health care FSA and limited-purpose FSA

A health care FSA and limited-purpose FSA are used to cover medical, prescriptions, hearing, dental or vision expenses that you would otherwise pay for out of pocket. Common qualified expenses typically include:

- The deductible, coinsurance or copayment amounts for your health plan, eyeglasses or contact lenses, dental work and orthodontia, medical equipment, hearing aids and chiropractic care .

- Many over-the-counter drugs, such as cold and allergy medicines, pain relievers and antacids, can also be reimbursed through an FSA. Your employer may limit what expenses your plan reimburses, so contact your HR department for more information .

- For a list of eligible expenses, see IRS Publication 502. Another great feature is that FSA funds are front loaded to the account, meaning they’re available at the start of your plan year .

Dependent care FSA

A dependent care FSA — also known as a dependent care assistance program (DCAP) — covers employment-related expenses for childcare. Qualified expenses must be for services that allow for you to go to work.

Typical expenses include charges for daycare, nursery school and elder care (though not if it is for medical care) for your legal tax dependents. Note that a dependent care FSA is not front loaded, meaning funds are available to you as they are added to your account.

Expenses must meet the IRS definition of eligible dependent care services. Typical expenses include:

- Daycare

- Nursery school or preschool

- In-home care, such as a babysitter or nanny

- After-school care

- Senior daycare

Note that a dependent care FSA is not front loaded, meaning funds are available to you as they are added to your account.

Important: Expenses are treated as having been incurred at the time the medical care was provided, not when you are formally billed, charged or pay for the medical expenses. You cannot receive reimbursement for future or projected expenses. All submitted expenses are reviewed for eligibility according to Internal Revenue Code Section 125 guidelines.

Before you enroll, consider the following questions to help estimate your costs:

- What dependent care services will you need during the year?

- How often will you use these services?

- How much will everything cost?

Automatic dependent care enables participants to be automatically reimbursed for dependent care expenses by filling out one form instead of filing multiple claims throughout your plan year.

Automatic dependent care works in one of the following ways:

- If the cost of childcare per month meets or exceeds your monthly payroll deduction, reimbursement will be issued as payroll deductions posted to your dependent care reimbursement account.

- If the cost of daycare is less than your monthly payroll deductions, reimbursement will be made once per month at the end of the month.

To set up automatic dependent care reimbursement, complete the FSA recurring dependent care request form.

The FSA Automatic Dependent Care Request Form needs to be completed each plan year. Changes can be made anytime by submitting an updated FSA Automatic Dependent Care Request Form.

Featured resources

Article

Learn how to file claims and receive reimbursements for eligible dependent care FSA expenses thru Optum Bank. Simple steps and helpful resources included.

Health benefit account

Maximize your health care savings with an Optum Bank FSA. Use pretax dollars for everyday medical expenses and save up to 30% on eligible purchases.*

Video

Watch this video to learn how you can use tax-free money to pay for dependent care.

*Savings compares using pretax income in your DCFSA to using after-tax income for expenses and assumes a 30% combined tax rate from all applicable federal, state and FICA taxes. Results and amount will vary depending on your circumstances.

**Data rates may apply.

***Income taxes may apply in certain states.